Insider Activity Report: MSCI (MSCI)

Henry Fernandez, CEO at MSCI (MSCI), recently bought 13,000 shares. The buy increased his holdings by 6%, and came to a total cost of $6.06 million. He was joined by the company COO, who bought 7,500 shares for about $3.4 million on the same day. This marks a shift from last year, when company insiders were sellers of shares, including the company CFO. The sales mostly occurred at higher prices from where MSCI trades today. Overall, MSCI insiders own 3.2% ...

Read More

Read More

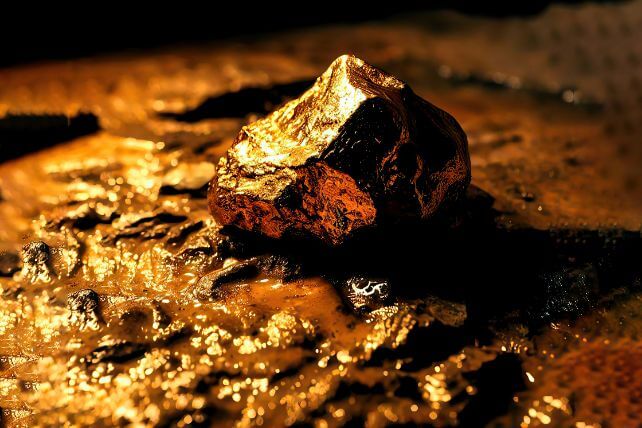

Unusual Options Activity: Barrick Gold (GOLD)

Gold prices have been trending higher this year, and so have gold miners. One trader is betting that major gold miner Barrick Gold (GOLD) will see massive gains in the months ahead. That’s based on the November $25 calls. With 199 days until expiration, 3,082 contracts traded compared to a prior open interest of 175, for an 18-fold rise in volume on the trade. The buyer of the calls paid $0.25 to make the bullish bet. Barrick shares recently traded for about ...

Read More

Read More

Buy the Short-Term Bumps in Booming Industries

Investors can make great returns with the right blue-chip stocks, provided they’re bought at the right time. Many companies go in and out of favor with the market for various reasons, and earnings season can lead to quick drops. However, for sectors that have bullish longer-term trends behind them, a drop following earnings can be a great investment opportunity. It can allow investors to buy in and get a reasonable price on a company likely to outperform for years. Right now, the ...

Read More

Read More

Insider Activity Report: Regions Financial (RF)

William Rhodes, a director at Regions Financial (RF), just picked up 50,000 shares. The buy increased his holdings by over 1,000%, and came to a total cost of $968,500. This marks the first insider buy since last May, when another director bought 11,926 shares at a cost of $200,134. In the past year, there have been two insider sales from company executives, with the largest sale coming to a cost of just under $500,000. Overall, Regions insiders own 0.3% of ...

Read More

Read More

Unusual Options Activity: SLM Corporation (SLM)

Student lending service company SLM Corporation (SLM) is up 44% over the past year, roughly double the return of the S&P 500. One trader sees a potential pullback in the coming months. That’s based on the July $20 puts. With 80 days until expiration, 6,008 contracts traded compared to a prior open interest of 107, for a 56-fold rise in volume on the trade. The buyer of the puts paid $0.46 to make the bearish bet. SLM shares recently traded for just ...

Read More

Read More

This Oversold Commodity Is Finally Trending Higher

The commodity market moves to the beat of its own drum, usually reflecting specific supply and demand dynamics. A number of commodities have seen either a supply shock or rising demand in recent years. Those tend to be good for prices. Sometimes, however, commodities fall out of favor. For instance, declining demand for EVs has led to a big drop in lithium prices. Lithium is a key component for rechargeable battery technologies, and EVs are a big chunk of that demand. However, ...

Read More

Read More

Insider Activity Report: Mastercraft Boat Holdings (MCFT)

Coliseum Capital Management LLC, a major holder of Mastercraft Boat Holdings (MCFT), recently bought over 200,000 shares in two transactions. The buy came to over $4.2 million. The fund was an active buyer of shares in March, buying $3.25 million. And last September, the fund bought nearly 280,000 shares for just over $6 million. Over that time, there has been only one insider sale, with a director selling less than $140,000 of shares. In total, Mastercraft insiders own 3.6% of ...

Read More

Read More

Unusual Options Activity: Palantir Technologies (PLTR)

Big data analytics company Palantir Technologies (PLTR) has had a strong year, with shares up 180%. One trader sees shares trending higher in the coming weeks. That’s based on the May 17 $26.50 calls. The trade has 21 days until expiration, and 7,619 contracts just traded compared to a prior open interest of 147, for a 52-fold rise in volume on the trade. The buyer of the calls paid $0.40 to make the bullish bet. Palantir shares just traded for about $21.00, ...

Read More

Read More